Virtual Office Services - Low Cost Mail Forwarding - Secure Document Storage

How to set up as a Sole Trader or form a UK LIMITED Company.

Estimated reading time: 8 minutes

You’re starting a business and not sure where to start. In this post, we give you helpful advice on setting up as a sole trader or forming a company. Helpful tips and advice to help you on your journey to success.

Where do I start?

Brain Storm your idea.

A good place to start is to have a business plan. You can download Free business plans from the Princes’ Trust. This should consist of at least all the goals necessary to ensure you have a successful business.

Summary of the main points you need to consider:

A financial strategy.

Your customer base.

What you are going to sell?

How are you going to market your products?

A business structure.

What are the different business structures?

Sole Trader

Registering yourself as a sole trader or forming a company has its pro and cons.

Setting yourself up as a sole trader is the easiest way. All the money you earn is yours after you subtract any valid expense you incur in running your business, the resultant amount after tax is your ‘drawings’ – your personal income. As your earnings are not taxed at source, as in PAYE, you need to keep accurate records and submit a self-assessment tax return.

Is sole trader the same as self-employed?

They’re classed as one and the same. Working for yourself, you’re by definition a sole trader.

Working for another person or company, you’re classed as employed. You can work as self-employed and work for someone else at the same time. This is usually common if a person is part-time or does some other work besides their main employment. What’s important is you inform the tax authorities of your employment status.

Pros and cons of a sole trader setup

The con of being a sole trader is you are personally responsible for any liabilities incurred whilst running your business. The pro is, that you are your own boss and you make all the decisions.

Forming or incorporating a UK company is not difficult and it can protect you from liabilities as the company is a legal entity in its own right and recognised by law as a person with its own obligations and legal rights. You don’t take ‘drawings’ from a company as you do as a sole trader. You’re paid in the form of a salary or PAYE wages. Money is also taken from your company in the form of dividends from the profits of your company.

You can sell shares from your company. This is a good way to raise capital as you can set a price per share as your company grows.

Pros and cons of a company setup

The cons of such a setup are the administration of running a company is high. The pro is, that you portray a professional corporate image and are protected from liabilities. A more comprehensive explanation of how to incorporate limited companies is recommended to read before you go down this path.

Registration as a Sole Trader

It’s recommended that you open a business bank account. This is a necessary step so you can separate your business earnings from your personal account. You also need a business address. Your home address can be used, but this can expose you to identity theft and unwanted cold callers, especially if your business is online. At least use a Po box address if you are allowed.

Pick a business name, it’s a good idea to use one that reflects what you intend to do. Research the name to ensure that name is not currently used by another person or company.

You will also need to inform the tax authorities, in this case, HMRC. There is plenty of help and guidance on the UK Gov website. It’s also a good idea to educate yourself on income tax rates and VAT rates.

Even though you need to employ an accountant, having some insight is never a bad idea.

Registration as a Ltd Company

Firstly, register your company. The name should be significantly different from any other company on the register. You can search on companies’ house to check if your proposed company name already exists on the register. If it does exist on the register, then you will need to think of a new name as any attempt to register will result in a refused registration.

Company

A person of significant control is required – PSC, can control the company, though having more than 25% of shares, or, more than 25% of voting rights in the company, or, the right to appoint or remove the majority of the board of directors.

A director is required to ensure the company meets all of its statutory requirements. Finally, a company secretary is required, this can be the director and is the usual case in small one-man band companies. The director also needs an address for any statutory mail they receive, the company also needs an office address. You can use a Po box address in some circumstances, but it’s prudent to check. A provider who can set up your company usually provides these for you.

As we now know a company is a legal entity, you will also need to open a bank account in its own name. Applying for a bank account will require you to present your business plan to the bank. Also, all the names of the company directors.

Get an accountant

You need to employ an accountant. Keep all receipts and ensure you keep accurate records by utilising either spreadsheets or dedicated software.

You should always consult a qualified accountant on tax and accounting matters. A good charted accountant will save you a lot of headaches over time.

Market your idea

You need to market your product. This is where the hard work starts if your new business is to succeed. There are multiple avenues you can explore.

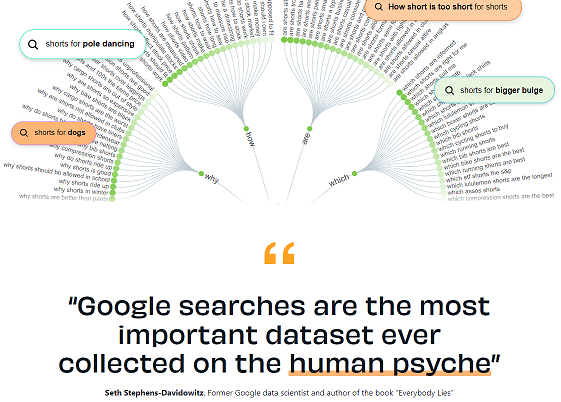

Answer the public

This online site answerthepublic is free to use and enables you to research what people are asking on every topic you can imagine.

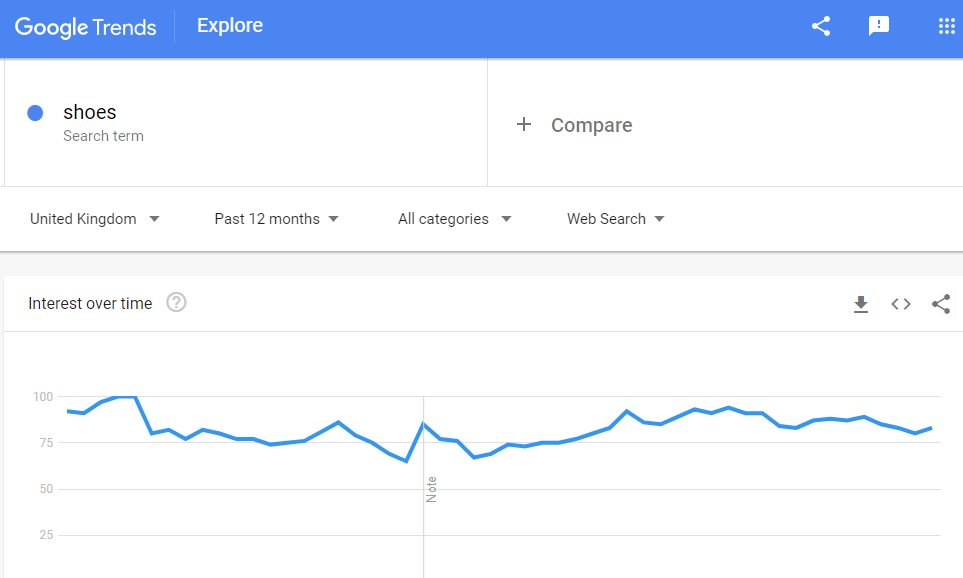

Google Trends

Google also offers free online tools like google trends. This lets you harness the power of Google and see what people are searching for.

Social Mention

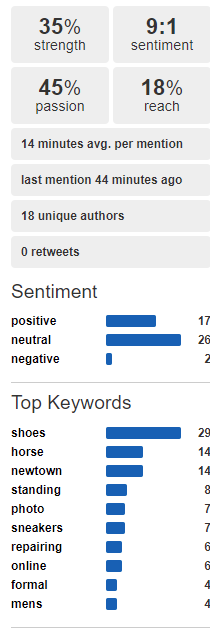

Social Mention is a real-time search engine. Extracting data from social media platforms.

Other avenues that are worth exploring are setting up a website. This can be time-consuming, but can reap rewards in the long term if it’s well designed. The upside of having your own website is you will be able to forge your own brand and style, but can be expensive.

Facebook and Instagram are other channels that can be used to further your path to a successful marketing campaign. As can word of mouth or better still recommendations.

Back to Top

Conclusion

We now hope you have a better upstanding of what you need to do when starting your business. Either being a sole trader or incorporating a company.

The Author