UK Ltd Companies: the definitive guide in setting one up

Estimated reading time: 15 minutes

You want to set up (incorporate) a limited company in the United Kingdom (UK). There’s plenty of information available on the internet, but it can be confusing and technical to read and understand. We’ll explain all you need to know about forming companies, registered offices, directors’ service addresses, and much more in easy and simple terms you can understand.

You’ve made the decision that you either need or want to form or incorporate a company as it’s more commonly known. There could be a variety of reasons why you have decided. It could be you are a successful sole trader, the size and nature of your business can change quickly and you need to expand to attract investors. The individual who has taken advice because of increased exposure to risk, that you need to open a company and limit your liability.

Either way, before you take the plunge you want to know more.

We’ll start at the beginning, or you can skip any section that does not interest you and go directly to the section that most interests you by using the table of contents.

What is a limited company?

Legally

In its simplest form, it’s a legal framework used to construct (incorporate) companies. Located within the UK, we use a law called the Companies Act 2006 to govern this framework.

One such company you can form is limited by liability. There are other company structures such as, limited by guarantee and limited liability partnership. However, we will focus on the limited by liability company framework.

The companies act states

“A company is a limited company if the liability of its members is limited by its constitution“

Meaning when forming or incorporating a company, documents called ‘memorandum of association’ and ‘articles of association’ are used to govern and guide it, using the rules set down in these constitutional documents.

The most common way of incorporating a company is using the default basic standard model of articles. By using these articles, any individual who acts for the company does so in the knowledge the company has agreed it will shoulder any liabilities as set down in its ‘memorandum of association’ and ‘articles of association’.

The company when formed (incorporated) and registered at Companies House, has gone through a legal process resulting in the law recognising it as an entity in its own right.

Think of it as a person who has just come into existence. And that it’s responsible for its own liabilities (debt) and assets (profit).

As this person (entity/company) cannot talk or make decisions, we need a living breathing person to act for it. We’ll call this person a director.

Read about how to set up as a sole trader and the differences between a sole trader and a limited company.

The director

A company can have many directors

Called a board of directors and headed (chaired) by another director, but for now, we will use one for the sake of simplicity. They must be over 16 and not necessarily reside in the UK or have a controlling stake.

The company needs to record each director in its own register. This can be a simple text file, as long as you keep a record.

The director must ensure the timely filing of company accounts, annual tax returns, and any other statutory documents. Allocating this to the company secretary is normal, but ultimately it’s the director’s responsibility.

Qualities of a director

A director should be an upstanding individual who will put the interests of the company first. Even though the company is limited by liability, that does not mean the company can be led astray and saddled with huge liabilities. There’s a huge difference between bad decisions and outright criminal activity and fraudulent trading. If a director has committed criminal activity they can be pursued legally as an individual.

Disqualified directors

It should be noted that a director cannot be appointed if disqualified from holding such a post through misconduct. You can search if a director is disqualified.

The company secretary

Optional

Though it’s usual for large PLC (public limited company) corporations to have a company secretary. It’s not required to have an appointed secretary for private Ltd companies since 2008 in the UK. But you may decide the size and complexity of your proposed company warrants a company secretary.

Role

The role of the company secretary is to assist the director in being compliant with statutory filings. This role is a responsibility of compliance rather than the traditional clerical duties of a secretary.

Any individual assigned this position, a position of trust, must be fully acquainted with what a company must do to be compliant. It’s not unusual for the director to assume this role. And it’s common in the case of one-person and very small companies.

Forbidden

It’s not allowed to appoint the company’s auditor which has to remain neutral to any circumstance that could affect the outcome of an audit. The company accountant is often offered this position as they have the necessary knowledge and experience in guiding directors.

It should be noted, however, that it’s still the director’s responsibility to ensure all compliance is being administered. Though in cases of outside negligence being proved, the director can be exonerated.

The company registered office

Required by law

It’s a legal requirement for the company to have an office. This is typically called the official registered office of the company and it’s listed on the public record at Companies House. It’s where the company can receive correspondence, that being official or otherwise.

There are some addresses you cannot use for a registered office. i.e. a certain type of Po Box. The address used for the registered office also needs to be a verified address, checked through the Royal Mail postcode checker.

Publicly available

Since it’s publicly available on Companies House, you need to be careful what address you use. You can use any address you are lawfully allowed to use. From using your garage where you trade from to your grandmother’s cottage (not recommended), as long as it’s a genuine address you can use it as a registered office.

Consider carefully

What you need to consider is this address is where the public can inspect your records. That is, your statutory records, not your day-to-day accounts you would use to send to your accountant.

Be aware, that the public cannot walk in unannounced. They must make an appointment and give 2 working days’ notice. And they can only inspect them for a maximum time of 2 hours.

Companies (Company Records) Regulations 2008.

The fact the public has the right to physically examine your documents would be unlikely as all records are freely available over the internet directly from Companies House. But, you need to be aware this is still a right that exists.

If you don’t fancy the idea of using your own designated company registered office you can always use a..

SAIL address

Single Alternative Inspection Location. Simply put, it’s an alternative address you register with Companies House, where you keep those documents. However, keep in mind it has to be located within the same jurisdiction where your company was incorporated, that being England and Wales, Scotland, or Northern Ireland.

Why would you use a sail address?

The most common scenario would be a company that has one main (head) office and several satellite offices that are trading under different incorporated companies. The head office would be the location of all the satellite offices’ documents. Therefore, the head office would be down as a sail address of these companies.

Remember, you need to register this office with Companies House as an alternative location by completing an ADO2 form and posting it to them. You can also do this through the Companies House web filing portal

Directors’ service or correspondence address

Required by law

The director is required to have a service address or a correspondence address it is sometimes referred to as. The service address is where any documents directly relating to the director are sent. This is available to the public through the public register.

Why does a director require a separate address from the company?

A person can be a director of many companies. If something goes wrong with a company they are a director of, i.e. Companies House filings are not submitted, legal documents are served on the director, or there is something wrong with the company’s mail not getting through to the registered office. Then they can be contacted through an alternate address.

Verified

The directors’ identity will be verified by Companies House. So, it’s important accurate information is supplied. Also, any service provider you use to provide company services will also need to verify identities.

Home address

The director also needs to supply their home address. It’s kept on a private register and not available for public viewing. Only the police and authorised bodies have access to it.

It should be noted, however, that if a director cannot be contacted through their service address. Companies House or HMRC will send any official mail to their home address as a last resort. Though this is not the case for the general public.

Removing your home address from companies house public register

Companies House in 2015 made 170 million records available for free. Obviously prior to this date directors’ addresses were not available for public viewing. Many used their home address on paper filings not realising this was going to happen.

However, you can apply to Companies House for it to be removed from each document for a fee of £32 per document by completing SR01 application form.

There are other circumstances where you can request for your home address to be removed because you are in danger or threat of attack.

People with significant control (PSCs)

Who is in control of the company (beneficial owners)?

It’s a legal requirement to identify exactly who’s in control. This can be the director, but what if there is a nominee director, or another entity, such as another company.

Even though a PSC is by definition an individual, another company can have control as they are classed as a legal entity.

A published guidance on the register of people with significant control by the UK government states.

Chapter 2, paragraph 2.21 “A legal entity must be put on the PSC register if it is both relevant and registrable in relation to the company“

Version: 3

Published June 2017

There is further guidance on the UK government website to help you understand.

In summary, you will need to identify which of these criteria applies:-

Someone who holds more than 25% of shares in the company

If any person or entity (corporate) with more than 25% of the company’s authorised share. That is, if the company has 100 authorised stock and has issued 26 to a person or entity and nobody else has a number greater than that.

This could also apply to 1 share out of 1 share of authorised stock issued to a director. That would equate to 100% held by the director.

Someone who holds more than 25% of voting rights in the company

If any person or entity can control the company at a general meeting, either through being a majority shareholder as explained above. Or having shares that have certain voting rights attached to them.

Special shares can have more than one vote attached, therefore a person can still be below 25%, but in essence, It’s like having more shares.

Someone who has the right to appoint or remove the majority of the company’s board

If any person or entity can fulfill any of the above criteria, then this will apply. This can also be the case if there is not one controlling shareholder – everyone has the same amount of shares below 25% – but a shareholders agreement is in place that gives one director overall control over the board.

Someone who otherwise has the right to exercise significant influence or control

Significant control can be asserted in different ways. This can be in the form of a signed letter by a nominee director who has over 25% share but has relinquished their control to another person. Therefore that person who does not fit into any of the above criteria will have control through the authority stated in the letter.

It could also be an investor who has invested large amounts of money but threatens to pull out if their demands are not met. Therefore, exercising control over the company through influence.

Why do you need to state who has significant influence or control?

The answer to that question is anti-money laundering (AML), tax avoidance, and identifying fraud. On 10 January 2020, the Fifth Anti-Money Laundering Directive (5MLD) came into force in the UK through the Money Laundering and Terrorist Financing (Amendment) Regulations 2019.

This was implemented to stop criminals from using various methods to commit fraud, i.e. using a multitude of companies to form complex corporate structures, making it extremely difficult who was actually controlling a particular company.

What if my company doesn’t have any PSCs?

It’s possible, but highly unlikely a company does not have any persons of significant control. Companies House has obligations to enforce this requirement. Failure to provide accurate information on the PSC register and failure to comply with notices requiring someone to provide information are criminal offences, and may result in a fine and or a prison sentence of up to two years.

Key points to consider are:

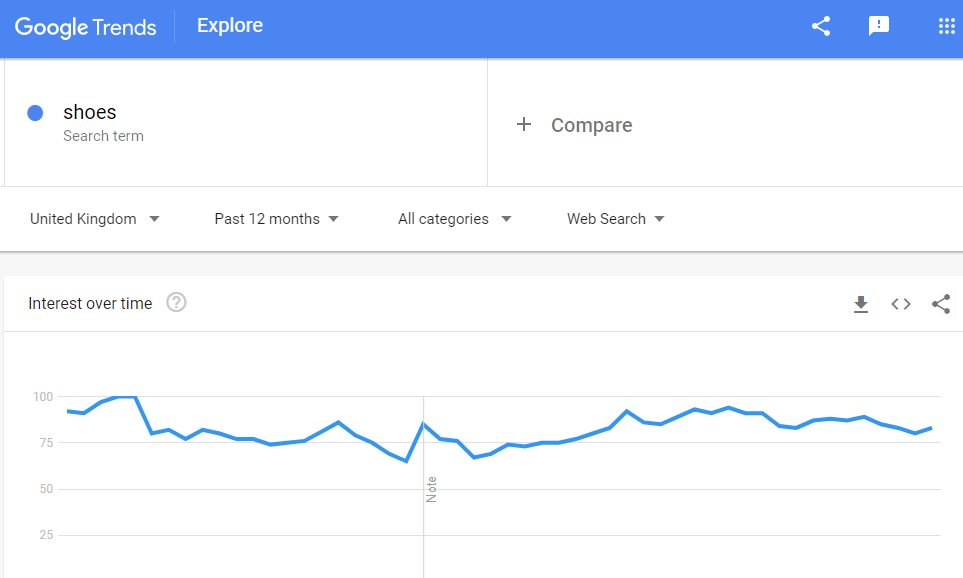

Shares

Ordinary share

As explained previously, shares play an important part in not only the control of the company but raising capital and sharing the profits.

Shares are best explained by thinking of them as slices of the company. The more slices you own, the more control and dividend payments you are entitled to.

When you first incorporate your company, you would allocate at least 1 (paid up) ordinary share of £1.00. There are many classes of share, but the simplest one is the ordinary share.

That share will give you as sole owner, complete control, as you have 100% of the allocated share capital.

Dividends

Dividend payment

Paying yourself a dividend from the profits will involve issuing a dividend payment for the amount you want to pay yourself. i.e. £25,000 dividend to be paid out to one share. This should only be paid from the profits after corporation tax has been deducted, and any other liabilities the company needs to pay.

Board meeting

A board meeting is required to authorise any decisions made for the company, this includes paying out dividends. Though not strictly required for one-person companies, it’s always a good idea to keep records (minutes) of what you have decided.

The typical format of minutes would look like this.

Your Company 123 Ltd

Registered office address

Held on (date of meeting)

Present: Yourself

It was resolved that the Company pay a final dividend of £25,000 per Ordinary Share in respect of the year ended (the company financial year end) to those shareholders registered at the close of business.

There being no further business, the meeting was closed.

Signed

(your name)

——————————

DIRECTOR (date of meeting)

Tax voucher

Issue a tax voucher to keep as proof of your payment to HMRC and enter into your self-assessment on the relevant date.

Your Company 123 Ltd

Registered office address

Dividend for the year ended (the company financial year end) payable to shareholders registered at the close of business.

Shareholder: (your name)

No. Ordinary Shares: 1 Dividend Rate: £25,000 Dividend Payable: £25,000

(your name)

——————————

DIRECTOR (date of meeting)

Keep this voucher in a safe place.

Use an Accountant

This is not financial advice, you should always consult a professional accountant before paying yourself any money from your company. This only demonstrates the basic format that should be used when paying yourself dividends.

Conclusion

We now hope you have a better upstanding of setting up a UK Limited company, whether you are a person or a corporate entity. It can be daunting at first, but with careful planning and accurate record keeping can result in many benefits and a professional image to your customers.

The Author